Last Updated on February 5, 2025 by teamobn

Just two weeks back, I wrote an article addressing the urgent need to build wildfire resilience into our homes. That article was prompted by the devasting fires in California, Victoria (AU) and Western Australia in January. Now, in the last week here in Australia, we have witnessed major flooding events caused by up to two metres of rainfall in just three days!

Naysayers, Trump included, can continue to deny global warming but the evidence is not only overwhelming – it’s becoming omnipresent!

The First Street Foundation, a US based non-profit organization that provides comprehensive climate risk data and analysis, has just released their latest annual report: The 12th National Risk Assessment: How Climate Change is Reshaping U.S. Property Values

First Street’s stated mission is to make the connection between climate change and financial risk – such as flooding, wildfires, and heat, for properties and communities as it affects financial institutions, companies, and governments.

The report runs to 44 pages so I have summarized it here. While the report is focused on the risks faced by Americans, it’s a wake-up call to every home-owner and property investor…

Contents

- 1 Introduction

- 2 1. The Growing Impact of Climate Risk on Real Estate

- 3 2. Insurance Costs: The Hidden Threat to Homeownership

- 4 3. Climate Migration: Where Are People Moving?

- 5 4. The Future of Property Values: Winners and Losers

- 6 5. How Homebuyers Can Adapt

- 7 Conclusion: The New Reality of Homeownership

Introduction

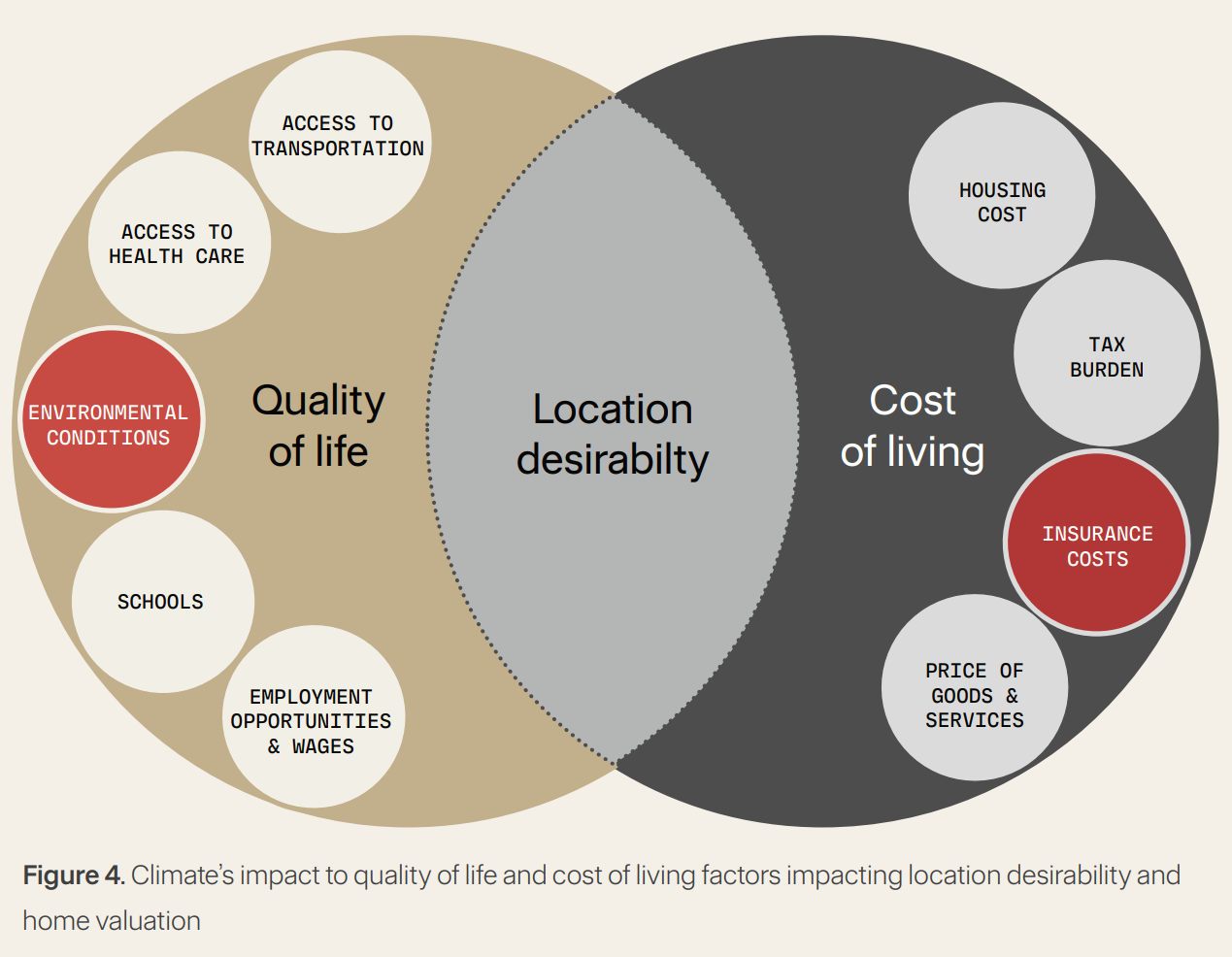

The U.S. housing market, valued at over $50 trillion, has long been considered a cornerstone of American wealth and economic stability. However, as climate change accelerates, new risks are reshaping the real estate landscape. The 12th National Risk Assessment: Property Prices in Peril by First Street Foundation highlights how climate risks, rising insurance costs, and shifting migration patterns are fundamentally altering property values across the country.

As extreme weather events such as wildfires, hurricanes, and floods become more frequent, homeowners face higher insurance premiums, decreasing home values, and shifting desirability for once-popular locations. Understanding these changes is essential for homebuyers, policymakers, and businesses alike.

1. The Growing Impact of Climate Risk on Real Estate

Climate change is no longer a distant threat—it’s actively influencing home values. In high-risk areas, properties that were once highly desirable are seeing insurance costs skyrocket, resale values drop, and buyer interest decline.

Key Findings from the Report:

- Insurance premiums have doubled in the last decade, making homeownership more expensive in high-risk areas.

- $1.4 trillion in real estate value is at risk due to climate-related disasters.

- Over 55 million Americans will likely relocate by 2055 to escape climate hazards, reshaping communities across the U.S.

- Coastal regions, wildfire-prone states, and flood zones will experience the steepest property value declines.

2. Insurance Costs: The Hidden Threat to Homeownership

A major driver of property devaluation is the rising cost of home insurance. Insurers are adjusting rates based on climate risks, and in some cases, withdrawing coverage entirely from high-risk areas.

Key Insurance Trends:

- Florida, Texas, and California have seen the highest increases in premiums due to hurricanes, wildfires, and flooding.

- Some areas are experiencing insurance premium hikes of 200-300%, making homeownership unaffordable.

- Insurers are pulling out of high-risk markets, leaving homeowners to rely on expensive state-run insurance plans.

- Mortgage lenders are factoring in insurance costs, further complicating home buying and selling decisions.

As insurance rates climb, homeowners are left with two choices: pay more for coverage or relocate to lower-risk areas. The latter option is fuelling a significant demographic shift across the U.S.

“Specifically, Florida has the highest average home premium across all states in the U.S., increasing by 47% over the past five years due to intensifying hurricane risks. Similarly, Colorado is among the top states for average insurance premiums and is also facing rapidly increasing premiums, growing

almost 40% due to growing wildfire threats and severe hail storms. North Carolina saw the largest increase in premiums at 95% from $2,256 in 2019 to $4,403 in 2024, as insurers adjust to the state’s emerging hurricane risk.“ First Street

3. Climate Migration: Where Are People Moving?

The report reveals that climate migration—the voluntary relocation of people due to climate risks—is reshaping the U.S. housing market. This shift is happening gradually, but its impact is already evident in property trends.

Projected Migration Trends:

- 55 million Americans are expected to relocate by 2055 due to climate risks.

- States like Vermont, Pennsylvania, and parts of the Midwest are seeing population increases as people move from high-risk coastal areas.

- The Sun Belt region (Florida, Texas, Arizona, etc.) is experiencing slowed growth due to climate risks.

- Some high-risk neighborhoods are becoming unlivable, leading to declining property values and economic downturns.

Communities that plan ahead by investing in resilient infrastructure and sustainable housing will be better equipped to retain and attract residents, whereas those that fail to adapt will face population losses and economic decline.

4. The Future of Property Values: Winners and Losers

As climate risks become more central to real estate decisions, home values are shifting in response to consumer demand, insurance costs, and government policies.

Who Will Benefit?

✅ Regions with lower climate risks (e.g., parts of the Midwest and Northeast) are expected to see increasing demand and rising property values. ✅ Homes built with climate resilience in mind (elevated homes, hurricane-proof structures) may retain or increase their value. ✅ Urban centers investing in flood prevention, wildfire management, and sustainable energy will attract homebuyers.

Who Will Lose?

❌ Coastal cities facing rising sea levels will see declining home values due to repeated flooding and property damage. ❌ Wildfire-prone states like California will struggle with affordability due to extreme insurance costs. ❌ Neighborhoods experiencing repeated climate disasters will lose long-term investment potential.

As more Americans consider climate risks in their housing decisions, the gap between “safe” and “high-risk” areas will continue to grow, influencing economic prosperity on a local and national scale.

5. How Homebuyers Can Adapt

For prospective homebuyers, navigating the evolving real estate market requires a new level of awareness and strategy.

Tips for Homebuyers and Investors:

- Check climate risk reports before purchasing a home. Free online tools like First Street Foundation’s Flood Factor can help assess risk.

- Understand insurance costs before committing. Some areas have premiums so high that they make homeownership impractical.

- Look for climate-resilient properties. Homes built with flood resistance, fire-proof materials, or strong wind-resistant designs will hold their value better.

- Consider long-term investment value. If a property is in a high-risk area, its resale value may decrease over time.

- Stay informed on local policies. Cities investing in climate adaptation projects may offer more stable real estate opportunities.

Conclusion: The New Reality of Homeownership

Climate change is no longer an abstract concept—it is actively reshaping home values, influencing migration, and driving up insurance costs. The 12th National Risk Assessment provides a crucial wake-up call for homeowners, buyers, and policymakers to rethink how they approach real estate investments.

Key Takeaways: ✔ Climate risks are lowering property values in high-risk areas while boosting values in safer regions. ✔ Insurance costs are making some homes unaffordable, forcing homeowners to relocate. ✔ Climate migration is shifting population growth away from traditional hotspots like Florida and California. ✔ Real estate decisions must now include climate risk assessments to ensure long-term stability and investment security.

As the landscape of homeownership evolves, those who plan ahead and factor in climate resilience will be best positioned for a stable and successful future in real estate.